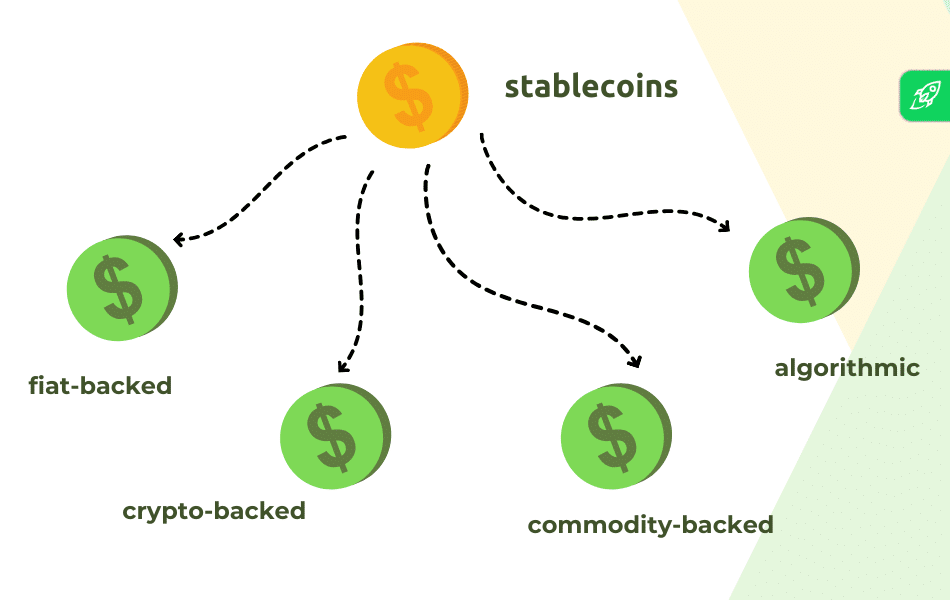

Cryptocurrencies are known for their volatility and can fluctuate rapidly in value. This makes it challenging to use them as a store of value or a medium of exchange. Stablecoins were created to solve this problem by offering price stability. They are digital currencies that are pegged to stable assets like fiat currencies, precious metals, or commodities. USDC and USDT stablecoins are the most popular representatives of this type of digital assets on the crypto market, but what exactly are they, and how do they compare? The comparison between USDC vs USDT offers insight into their unique characteristics and how they function within the crypto industry.

Key Takeaways

- USDT has a higher market capitalization and significantly larger trading volume than USDC, making it the preferred choice for traders.

- USDC is known for its transparency: regular audits and clear compliance with regulatory standards like the SEC and MiCA contribute to its reputation.

- USDT’s backing includes diverse assets like U.S. Treasury Bills, but the stablecoin has faced criticism for historical opacity and regulatory challenges.

- USDC benefits from a straightforward reserve structure, primarily backed by cash and U.S. Treasuries, ensuring transparency.

- USDT is more battle-tested and widely adopted, while USDC stands out for its stronger compliance and transparency.

What are Fiat-Backed Stablecoins?

Fiat-backed stablecoins are the most common type of stablecoins. They are backed by fiat currency reserves held in a bank account. The amount of underlying fiat currency held in reserves should be equal to the number of stablecoins in circulation so that the stablecoin is fully collateralized. If the stablecoin is pegged to the US dollar, then it is referred to as a USD stablecoin.

Advantages of Stablecoins

Stablecoins offer a host of benefits, including their steady value, clear transparency, and high efficiency. These types of cryptocurrency are versatile, serving as a reliable store of value, an effective medium of exchange, or a consistent unit of account. They are particularly useful for cross-border payments, small-scale transactions, and remittances. Notably, USDT and USDC stablecoins stand out for facilitating low-cost, fast interactions and enabling users to accrue interest through decentralized finance protocols.

In comparison to traditional finance, stablecoins have several distinct advantages. Their decentralized framework allows for rapid, low-fee global transfers, circumventing the need for conventional financial intermediaries like banks. This aspect is especially appealing as it aligns with the increasing demand for stablecoins on major exchanges. Additionally, stablecoins offer enhanced security as an investment option, thanks to their foundation in blockchain technology, which ensures tamper-proof transaction records and safeguards user funds. Furthermore, many stablecoins adhere to regulatory compliance standards and undergo periodic audits, adding an extra layer of trust and reliability for users.

Why are there so many USD stablecoins?

The US dollar is the dominant global currency, and many people and businesses around the world use it for trade and commerce. USD stablecoins allow people to transact in USD without a traditional bank account. Additionally, they provide an efficient way to move money across borders, bypassing the fees and delays associated with traditional remittance services.

Stablecoins facilitate easy transfers and storage of value for users across cryptocurrency platforms, providing a safe option compared to the price volatility of such digital assets as Bitcoin and Ethereum.

What factors make a stablecoin safe?

The safety of a stablecoin is dependent on several factors, including its reserve assets, the level of transparency provided by the issuer, and the regulatory framework within which it operates. A stablecoin backed by a large reserve of a trusted fiat currency and audited by a reputable third party is considered safer than a stablecoin backed by an unknown asset or an unaudited reserve.

MiCA’s Impact on Stablecoin Safety

The EU’s Markets in Crypto-Assets (MiCA) regulation is designed to provide a comprehensive framework for cryptocurrency and stablecoin regulation across Europe. It mandates stablecoin issuers to obtain e-money licenses and adhere to transparency and reserve requirements. MiCA ensures that only compliant stablecoins with audited reserves and proper authorization are granted the right to operate in the EU. This could benefit USDC, which already follows strict regulatory protocols, while USDT might face greater challenges due to its historical lack of transparency.

What Is Tether (USDT)?

Tether (USDT) is the oldest and most popular USD stablecoin that was launched in 2014 with the goal of creating a bridge between cryptocurrencies and traditional fiat currencies. It is pegged to the US dollar and backed by a reserve of fiat currency and other assets. Tether is the most widely used stablecoin, with a market capitalization of over $70 billion.

You can learn more about Tether tokens in this article.

USDT Stability

In 2017, Tether was hacked, and 31 million USDT tokens were lost. The project got criticized as many pointed out that instead of taking responsibility and demonstrating accountability, they initiated an “emergency hard fork” to save face.

In 2017, Tether was hacked, and 31 million USDT was lost. Instead of taking responsibility and demonstrating accountability, they initiated an “emergency hard fork” to save face. This caught the attention of the New York Attorney General when it was discovered that Tether was lending out its cash reserves without being able to adequately back their tokens with USD. They attempted to absolve themselves of responsibility by antagonizing the Attorney General instead of providing a rational defense.

USDT Volume

According to CoinMarketCap, the current market capitalization of USDT is around $111 billion, and it is the most widely used stablecoin in the world. This makes Tether the third crypto asset by market capitalization, only surpassed by Bitcoin and Ethereum.

Suggested article: What is volume in cryptocurrency?

What Is a USD Coin (USDC)?

USDC, or USD Coin, takes second place in the list of the most popular stablecoins. It was launched in 2018 by Circle, a fintech company based in Boston.

The Centre consortium, which includes Circle and Coinbase, issues and manages USDC. Centre is the only entity that can control USDC supply, similar to the Federal Reserve controlling USD. However, there is a major difference between USD and USDC — Circle has full authority over USDC, which is not the case with USD and the FR.

USDC Stability

USDC Stability is considered to be more transparent than USDT because Circle provides monthly audits of its reserve assets. Additionally, USDC is regulated by the US Securities and Exchange Commission (SEC).

In March 2023, Circle reported that $3.3 billion of the cash reserves backing USDC tokens remained in Silicon Valley Bank, causing it to depeg and drop in value against the dollar to 87 cents. In addition, similar dollar-backed stablecoins such as DAI and USDD were depegged from their original value of $1. However, it only took USDC 2 days to return its peg.

USDC Market Capitalization

According to CoinMarketCap, the current market capitalization of USDC is over $34 billion, and it is the second most widely used stablecoin in the world after USDT.

Tether vs USDC: Comparative Analysis

An analysis of the differences between Tether and USD Coin can be helpful. Both are stablecoins, though they have some different key features and should each be examined before investing. Let’s start with the similarities they share.

They are both stablecoins

USDC and Tether are almost indistinguishable, differing in market cap. Both Tether and USD Coin are stablecoins, meaning they have a fixed value that is pegged to the US dollar. This makes them less volatile than other other crypto assets, so they can serve as a store of value or a medium of exchange. However, they cannot be treated as perfect substitutes for the US dollar since it’s impossible to deposit them into a bank account or use them for payments.

One-to-one (1:1) value ratio with USD

Both Tether and USD Coin maintain a one-to-one (1:1) value ratio with the US dollar. This means that for every USDT or USDC token issued, there is a corresponding US dollar held in reserves.

Blockchain variation

Both Tether and USDC stablecoin had operated solely on the Ethereum blockchain, but gained representation on multiple blockchains since then, which allows for rapid transferral and low transaction fees.

Blockchain transparency

Both Tether and USD Coin provide transparency in terms of their blockchain transactions. This allows users to track their transactions and ensure that they are getting what they paid for.

Rapid transferral

Both Tether and USD Coin can be transferred quickly and easily, which makes them ideal for peer-to-peer transactions and remittances.

USD Coin vs Tether: What are the Key Differences?

Tether (USDT) and USD Coin (USDC) are two of the most popular stablecoins in the cryptocurrency space. While both stablecoins share some similarities, there are also some key differences between them:

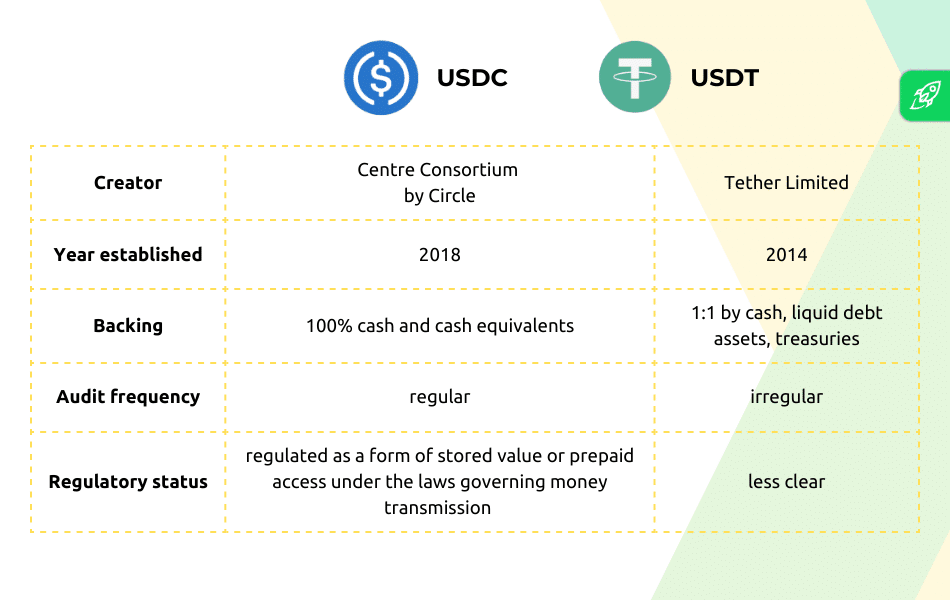

Launch date

Tether was launched in 2014, while USD Coin was launched in 2018. This means that Tether has been around longer and has had more time to establish itself in the market.

Reserve Assets

Both Tether and USD Coin are backed by a reserve of assets, such as fiat currency and other financial instruments. However, concerns have arisen regarding the stability and transparency of Tether’s reserves, as the company has faced accusations of using unbacked reserves to support the value of its stablecoin.

As of 2024, Tether (USDT) is primarily backed by U.S. Treasury Bills and other assets. According to Blockworks, approximately 58% of Tether’s reserves are held in U.S. Treasuries, with the remaining reserves consisting of cash and cash equivalents (about 9%), secured loans (around 9%), and various other investments, including crypto holdings, corporate bonds, funds, and precious metals. This diverse backing has drawn scrutiny and calls for greater transparency and regulation.

In contrast, USD Coin (USDC) is backed by a more straightforward reserve policy, primarily consisting of cash and short-term U.S. Treasuries. Around 75.6% of USDC’s reserves are held in U.S. Treasuries, while 24.4% remain in cash at regulated financial institutions. Circle, the issuer of USDC, ensures compliance with financial regulations by holding these reserves with regulated financial institutions.

Circle has earned public trust by maintaining a positive reputation and providing detailed disclosures about its reserve assets, while Tether continues to face controversy due to perceived opacity and unregulated centralization. Tether’s lack of transparency has been highlighted by its omissions regarding the specific composition of USDT’s backing, contrasting sharply with Circle’s commitment to regulatory compliance and openness.

MiCA Compliance: USDT vs. USDC

Under MiCA, stablecoin issuers must obtain e-money licenses to operate within the EU. This regulatory framework may heavily impact Tether (USDT) as it faces challenges in maintaining market access due to concerns over transparency and reserve management. On the other hand, USDC, with its established compliance protocols and regular audits, is better positioned to meet MiCA’s strict standards. As a result, European exchanges may prioritize USDC over USDT, affecting liquidity and market share in the region.

Trade/liquidity volume

Tether (USDT) consistently maintains a higher market capitalization and larger trading volume compared to USD Coin (USDC). According to CoinMarketCap, USDT’s daily trading volume is approximately $50 billion, significantly overshadowing USDC’s $5 billion in daily transactions—roughly ten times more. This substantial difference in liquidity and trading volume makes Tether a more popular stablecoin among traders and investors, as it offers greater availability and market activity.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

USDC vs USDT: Concluding Thoughts

Stablecoins are essential to the crypto ecosystem, as they are blockchain-based tokens with a stable value linked to fiat currency. Stable tokens ensure users can conveniently transfer and hold value across various crypto platforms without the exposure to price fluctuations common in digital assets such as Bitcoin and Ethereum. USDT, USDC, and BUSD (Binance USD) form the bulk of the stablecoin sector’s market cap, making them ideal choices for investors looking to become part of the stablecoin market.

Overall, while both Tether and USD Coin are stablecoins designed to maintain a 1:1 value ratio with the US dollar, there are some key differences between the two. Tether has a longer history and a larger trading volume, but it has faced some controversy over the stability of its reserve assets. USD Coin, on the other hand, has been more transparent about its reserve assets. Yet, it has a smaller trading volume. Ultimately, the choice between Tether and USD Coin will depend on the individual needs and preferences of the user.

USDT vs USDC: FAQ

Is USDT fully backed?

Tether (USDT) claims that it is fully backed by reserves, and recent reports suggest that its reserves are even over-collateralized. As of mid-2024, Tether has stated that it holds $118.4 billion in reserves, surpassing the amount of USDT in circulation, which is about $113 billion. This includes a mix of cash, U.S. Treasury bills, and other assets, providing a cushion beyond the 1:1 peg required for full backing.

Is Bitcoin a stablecoin?

No, Bitcoin is not a stablecoin. Unlike stablecoins, which are designed to maintain a fixed value, Bitcoin’s value is highly volatile and can fluctuate significantly based on market demand and other factors.

Is USDT equal to USDC?

Yes, USDT (Tether) and USDC (USD Coin) are both pegged to the U.S. dollar, and, therefore, equal in value. They are designed to provide stability in the face of market volatility, offering a consistent value of one dollar per coin.

Which stablecoin is best?

Deciding between USDT and USDC is challenging: both have their benefits and drawbacks and enjoy strong reputations and widespread popularity. To learn more about how these stablecoins compare to others, check out our article on the five best stablecoins here.

Is Usdt and USDC the same?

No, they are two different assets. Both USDT (Tether) and USDC (USD Coin) are popular choices in the crypto community, serving as fiat-collateralized stablecoins within the cryptocurrency ecosystem. Despite their differences, these two types of cryptocurrency share the common goal of offering a stable, digital currency pegged to the US Dollar.

What is the difference between USDT and USDC?

USDT (Tether) and USDC (USD Coin) are both stablecoins designed to remain valued at $1. They differ in several aspects: issuer, transparency, regulation, adoption, and blockchains they run on. USDT is issued by Tether Limited, while USDC is released by Centre Consortium. USDC complies with US anti-money laundering and know-your-customer regulations and is subject to regulatory scrutiny. Meanwhile, Tether Limited has encountered legal issues and has been the focus of investigations by the New York Attorney General. However, USDC is less adopted than USDT.

Is USDT better than USDC?

There is no simple answer to this question. When choosing between USDT and USDC, it is important to understand the differences between the two. USDT is more established, while USDC is growing in popularity for its compliance and transparency. Ultimately, the choice of the most suitable stablecoin depends on individual preferences and requirements.

What is the downside of USDC?

USDC, like other stablecoins, faces common drawbacks such as centralization risks due to its management by a single entity, Circle, and regulatory risks linked to the evolving financial regulation landscape. It also carries counterparty risks, relying on the trustworthiness of Circle and its banking partners. In addition, USDC is tied to the traditional financial system, inheriting its vulnerabilities, and is subject to smart contract risks inherent in blockchain technology. While offering stability, it lacks the high return potential of more volatile cryptocurrencies, presenting a limited use case primarily as a stable medium of exchange or store of value.

Looking to buy stablecoins like USDT or USDC? Consider using Changelly, a reputable cryptocurrency exchange that allows you to buy and sell a wide variety of cryptocurrencies with ease. With Changelly, you can quickly and securely purchase stablecoins using your credit or debit card without complicated verification processes. Additionally, Changelly offers competitive rates and a user-friendly interface, making it a great choice for both beginners and experienced traders. Start buying stablecoins today on Changelly!

Is USDC Still Safe?

Some investors consider USDC a safer stablecoin than USDT, as it is more transparent and regulatory-compliant. Its regular audits and real-time reports on reserves provide assurance that the token is backed by actual assets. Conversely, USDT has been met with scrutiny due to doubts surrounding its reserve backing and transparency.

What is the difference between USD and USDT?

USD (United States Dollar) is the fiat currency issued by the Federal Reserve Bank in the United States. USD is a physical currency in the form of paper money and coins, backed by the US government and used as a medium of exchange for goods and services.

USDT (Tether) is a digital, blockchain-operated stablecoin created to remain pegged to the US dollar. It’s issued by Tether Limited and supposedly backed by reserves consisting of an equal amount of USD.

The key difference between USD and USDT is that USD is a physical currency that the US government issues and backs, whereas USDT is a digital currency. Instead of the government, it is backed by an equivalent amount of USD that Tether Limited holds in reserve. Additionally, while USDT intends to maintain a steady value of $1, the value of USD is subject to market forces like inflation and interest rates.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.